How will High Yield fare in 2022 ?

Jerry Cudzil, TCW – December 9th, 2021

AFTER DISPERSION, COMPRESSION

In 2020, with the arrival of the pandemic and the successive confinements that followed, we saw a “K” shaped economic recovery, which translated into a strong sectoral dispersion in the high yield market, affecting in particular the travel and leisure sector (airlines, hospitality, rental cars, leisure, movie theaters, etc.), retail and real estate (retailers, restaurants, malls, commercial real estate, etc.) and energy (E&P, midstream, etc.).

These valuation differences offered many opportunities for active managers, particularly with the arrival within our investment universe of so-called “fallen angels”, i.e. companies that have fallen out of favour with the economic downturn and whose debt has therefore entered the high-yield playground (Ford Motor Credit, Occidental Petroleum, Kraft Heinz Foods, Carnival, etc.).

With the strong recovery in 2021, these fallen angels have become rising stars and credit spreads have narrowed considerably. We passed from almost 90% sector dispersion in 2020 to around 50% today. In the current year, virtually all sectors have risen and less than 2% of the high yield index trades were below 90% of their par value.

CHANGING CONSUMER HABITS

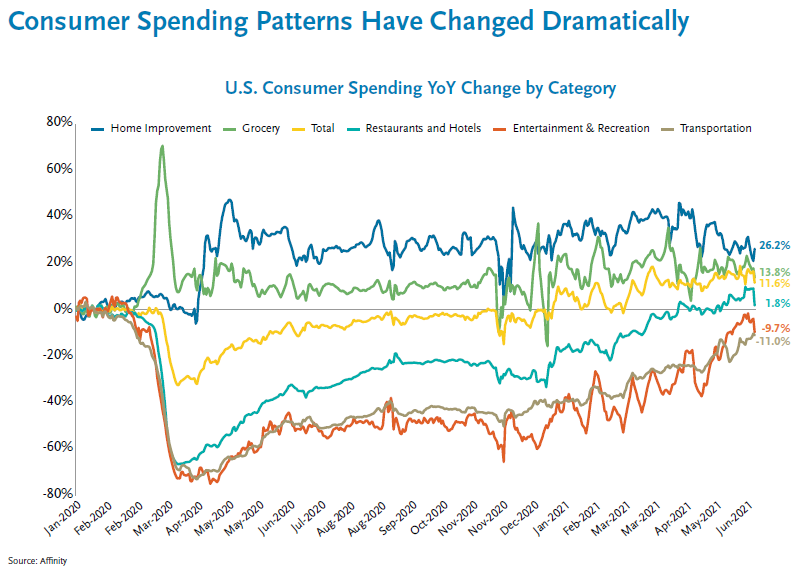

The pandemic has led to many changes in consumer habits. Confined to their homes, they refrained going to the office every morning, stopped going on holiday, ceased going to restaurants or cinemas to fill their pantries, start improving their homes, set up a home office or watch videos on streaming platforms.

The question now is which of these new habits will disappear once the pandemic is over and which of these changes will be structural.

Indeed, while some areas that benefited from the health crisis – such as personal protective equipment, DIY or home gym – should see their demand return to normal, other winners – such as online retail, logistics, streaming content – could instead continue their positive trend.

Conversely, some areas that plunged due to the health situation – such as elective surgery, restaurants, domestic air travel, rental cars and cruise lines – are expected to quickly recover their pre-crisis volumes, while others, including brick & mortar retail, commercial real estate and business travel, may never return to their previous levels.

Not all sectors are recovering at the same rate. While airport passenger traffic in the US is back to early 2020 levels, some new habits are harder to break and public transport use, office attendance and movie theater occupancy rates are only slowly recovering.

SHORTAGES ARE APPEARING IN MANY SECTORS

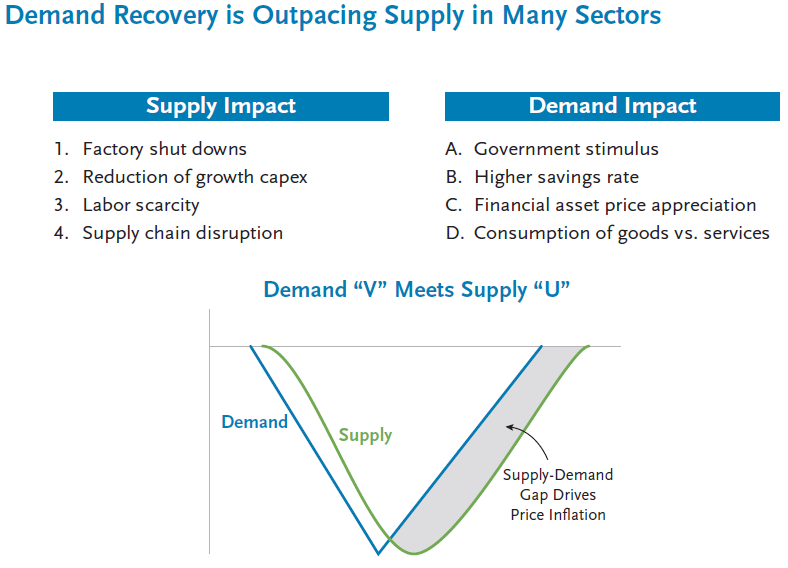

While aggregate demand has rebounded very quickly, forming a “V” curve, supply has not been able to adjust at the same speed and is instead following a “U” curve.

Indeed, the recovery in demand was accelerated by a number of factors, such as government stimulus programmes, the increase in savings rate, the appreciation of financial assets and the shift from services to goods consumption. Conversely, several factors have had a negative impact on the supply side. Firstly, like an ocean liner that takes miles to change direction, the reopening of a shutdown factory does not happen overnight. In addition, the restart of production was penalised by the reduction of growth in investment spending and the scarcity of labour. Finally, numerous bottlenecks have appeared in the supply chains.

This mismatch between supply and demand has led to higher input costs, with surges in commodities, base materials and shipping costs, resulting in higher consumer prices that are causing concern in the markets

IS INFLATION HERE TO STAY ?

As we have seen, the current rise in prices is due to an imbalance between supply and demand rather than a loss of trust in the currency. Fortunately, this type of inflation tends to be self-correcting, as supply will increase to meet demand and take advantage of the higher prices, which will naturally resolve the imbalance.

The current inflation therefore seems to be transitory in nature. However, it should be noted that deglobalisation and protectionism may slow down this return to equilibrium and that certain underlying “super trends”, such as massive infrastructure investments, the inevitable energy transition and ESG and data protection issues, are likely to have a lasting impact on price levels.

THE CHALLENGE OF THE POST COVID PERIOD

The “post-COVID world” will face many challenges that credit managers will obviously have to deal with. Indeed, in addition to the major issue of monetary policy normalisation and regulation, it must be recognised that many geopolitical uncertainties remain and that supply chain issues are still far from being resolved. More fundamentally, it is undeniable that the pressure for more sustainable investments and for an acceleration of the energy transition will not go away.

For us, as High Yield managers, this means that we will have to be very adaptable in our credit selection. Therefore, we will give preference to issuers with the following characteristics:

- Flexible and multivariate business model

- Diversification across products, customers and supply chains

- Optionality in capital structure and investor base

- Action-oriented and realist management teams

CORPORATE CREDIT FUNDAMENTALS

The year 2021 has not been a “normalization” year. Consumer demand remains volatile and supply chain disruption continues. For credit strategies, however, fundamentals remain strong overall, although sector dispersion continues.

For 2022, attention should be paid to the issue of corporate deleveraging, as well as to the weakening of margins and free cash flows. Finally, we should expect interventions by central banks, which may (finally) attempt to normalise their monetary policies. All these elements will necessarily have an impact on the credit market and our active management will be an asset to face them.

ACTIVE MANAGEMENT IS ESSENTIAL FOR INVESTING IN HIGH YIELD

As mentioned above, there will be no shortage of uncertainty in the coming months. Whether it is due to changes in consumer habits, doubts about the post-COVID recovery, fears of a return of inflation or the prospect of a normalisation of central bank monetary policy, we can expect significant volatility and some sector rotation.

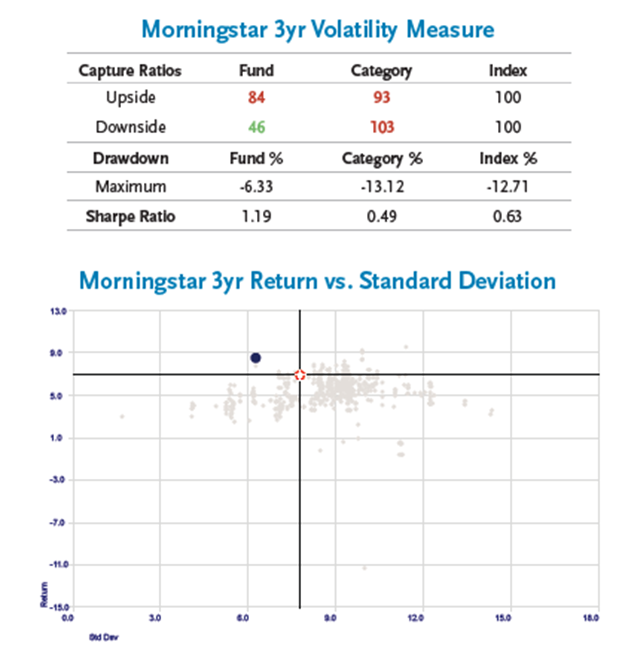

This makes it more important than ever to have active managers like those in the TCW Funds-MetWest High Yield Bond Fund (★★★★★ Morningstar). Whether it’s positioning in terms of duration, yield curve slope, credit quality, sector allocation or security selection, TCW’s management team has proven its ability to deliver superior performance without compromising on credit quality.

As can be seen below, the fund ranks particularly well in terms of risk-adjusted performance. The care taken to reduce downside risk is particularly interesting in this uncertain environment. This approach resulted in one of the best performance last year (+12.2%) over performing more than 5% the index (+7.05%). Please see more details in the latest factsheet of the institutional USD share class (LU1377851966) and Euro Hedge Institutional share class (LU1377851701). Do not hesitate to contact Prosper if you need more info or other share classes.

Publication (FR) – Allnews – December 9th, 2021

Publication (FR) – Investir.ch – December 13th, 2021

PROSPER NEWS

Get the latest fund managers news, comments or analyses.

Prosper Stars & Stripes – Market Review Q4 2024

Prosper Stars & Stripes : Review Q4 2024 by Christopher Hillary, Roubaix Capital CEO and Fund Manager. During the fourth quarter of 2024, Prosper Stars & Stripes gained 2.6% compare to the Small and Mid caps market which gained 0.3%. Christopher Hillary...

PWLSE : L/S fund launch

Press releaseProsper Professional Services Announces the Launch of the UCITS Fund: Plurimi World Long Short Equity (PWLSE): Innovation Driving Performance Prosper, a key player in fund distribution for professional clients based in Switzerland, announces the launch of...

TCW – Q4 2024 Talking Points

TCW Q4 2024 TALKING POINTS The TCW Group comments the Fixed Income market for the fourth quarter 2024 and presents its views going ahead. Please click on the link below to read the TCW Q4 2024 Talking Points. PROSPER NEWS Get the latest fund...

Wish to be informed ahead of the crowd through our emails?

Sign up to participate in the next events & presentations.

Retour

Retour