What I miss ?

by Brian G.Gelfand, TCW, Senior Vice-President, Fixed Income

Admittedly, it is virtually impossible to have actually “missed” the historic events that transpired in 2020. A global pandemic, suspension of economic activity, shelter-in-place mandates, equity market volatility, debt market seizure, unprecedented monetary and fiscal intervention, asset price reflation, TSLA, Bitcoin, Robinhood, HTZ, Special Purpose Acquisition Companies…an election, cyberattacks… Indeed, virtually impossible.

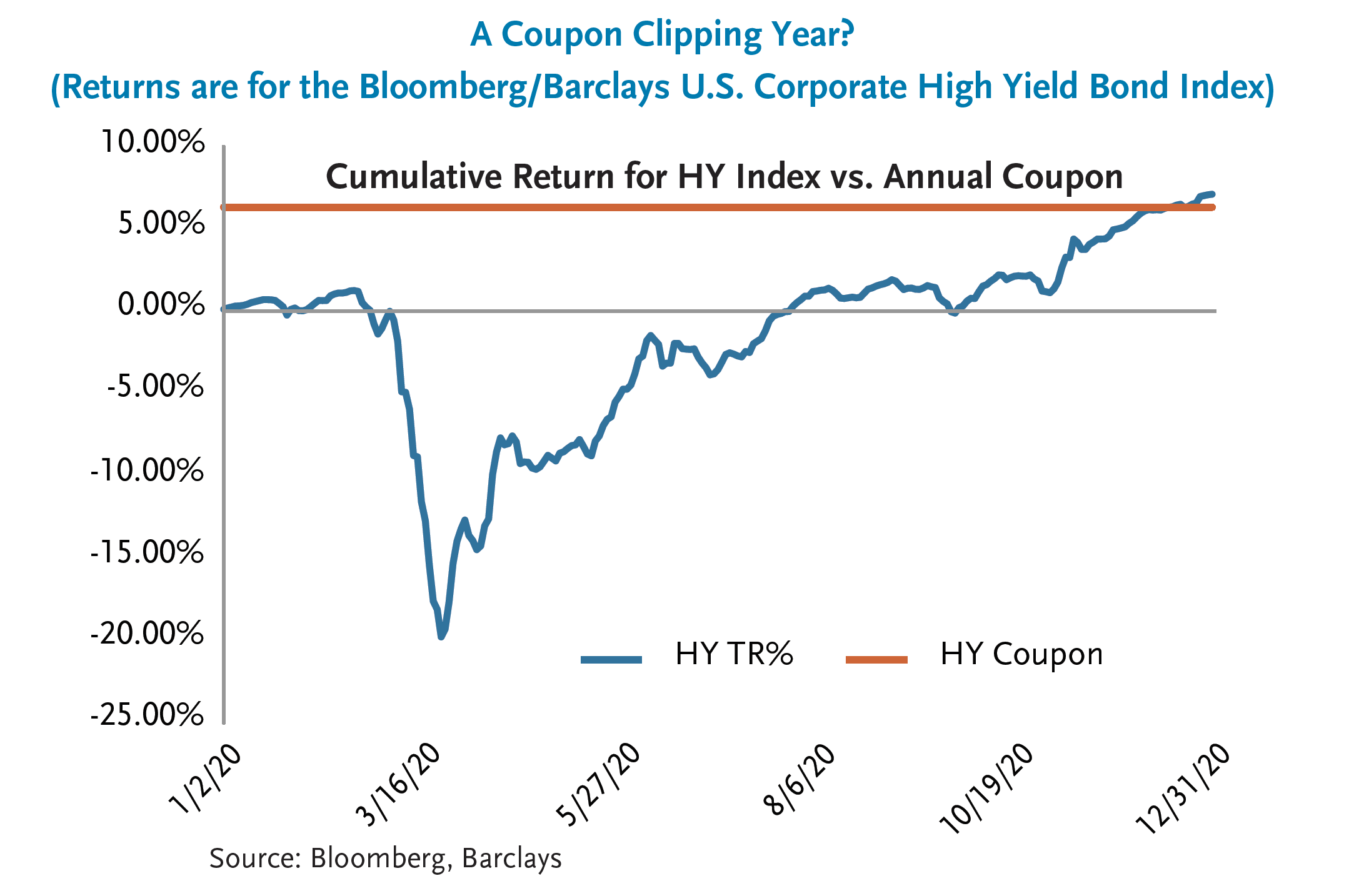

However, in an alternate reality where a high yield investor observed credit markets on January 1st, boarded a SpaceX flight to Mars, returned on December 31st and observed the markets again, they would not be faulted for thinking they didn’t miss much in the interim. A coupon-clipping year with some incremental yield compression, perhaps. As an aside, in this alternate reality, TSLA’s market capitalization may indeed be justified…but I digress.

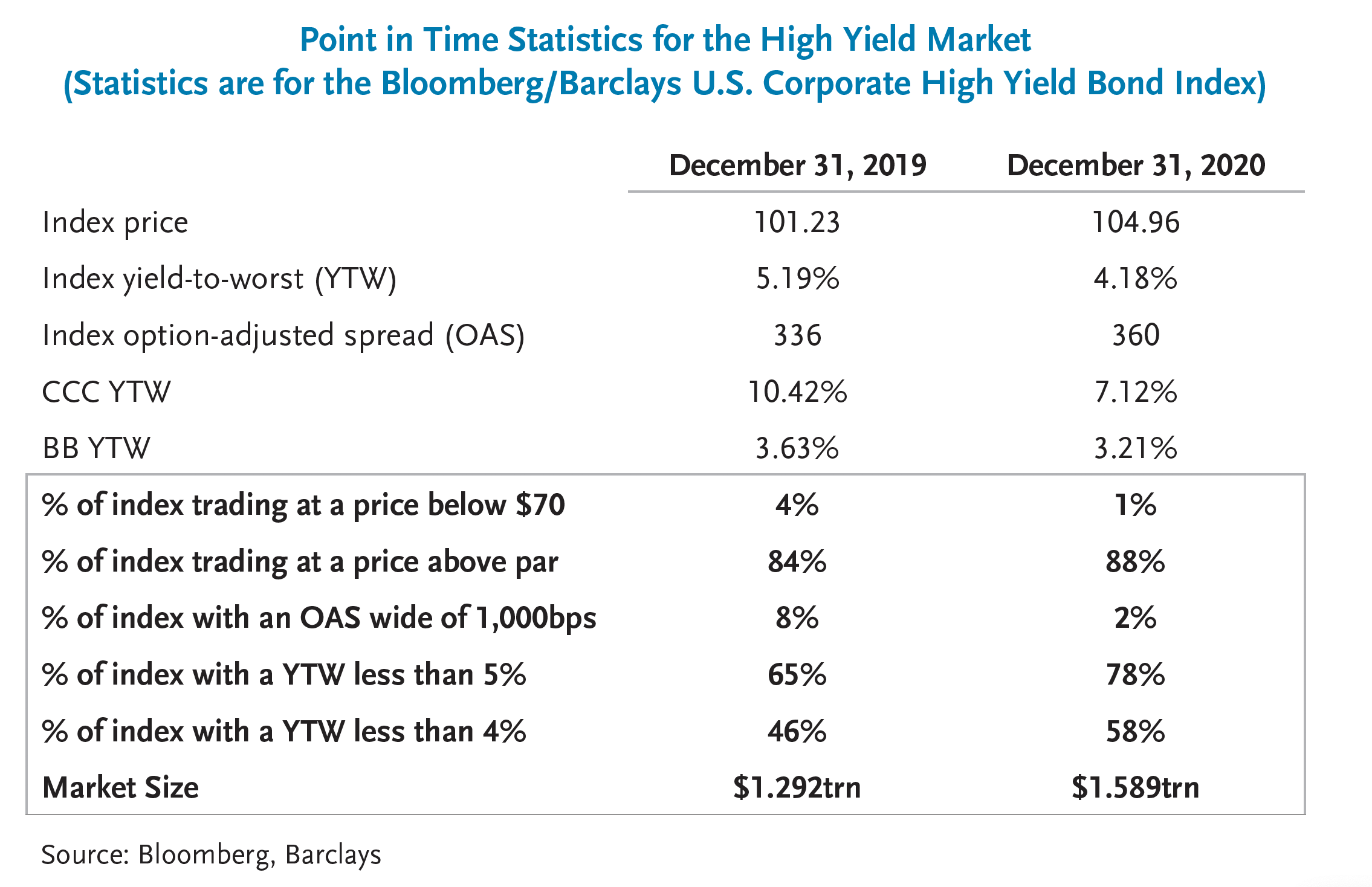

The narrative above is meant to frame the parallels that exist in the valuation regime in the high yield market between the beginning and end of the year. Option-adjusted spreads on high yield bonds widened to levels not seen since the global financial crisis in a matter of weeks only to compress to within a mere 25 basis points (bps) of the January 1st levels by year-end.

The truth of the matter is, 2020 was anything but a coupon-clipping year despite what the final score would suggest. The pandemic induced volatility created an opportunity for value managers who managed to preserve liquidity to get aggressive as valuations became very attractive and earn outsized returns on the year. The natural question as we look forward is: where do we go from here? We once again do not venture a guess. Indeed, at this time last year, who could have foreseen the events that unfolded in 2020 or mapped the reaction function of debt capital markets? We instead react to market prices. With spreads having remediated to cyclical tights and less that 1% of the high yield market trading below 70 cents on the dollar, it would seem the easy money has been made. All-in yields at record lows and hurdle rates for CCC-rated bonds now below 7% leave little margin for error, skewing risks to the downside. As such, future gains will likely be less attributable to market beta and more the result of discrete credit picks.

Market Performance

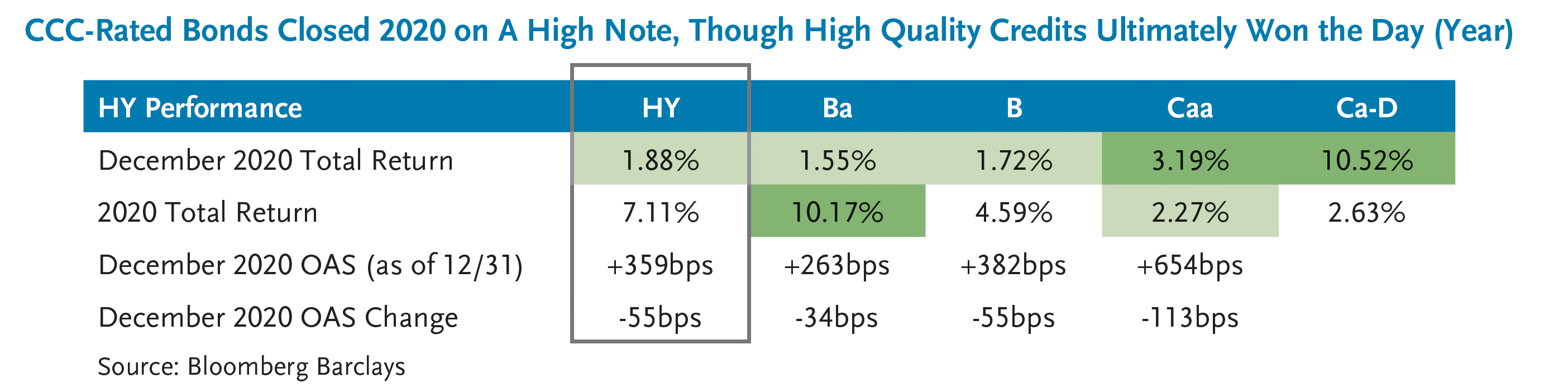

December can be characterized as a simple extension of the risk-rally observed in November with hurdle rates compressing further as investors (seemingly) indiscriminately reach for yield. A lot of the steam was exhausted in November. Indeed, after producing near 4% returns in November (with CCC-rated bonds returning an eye-popping +6.3%), high yield bonds can be forgiven for “only” returning +1.88% in December. This momentum into year-end brought full-year returns for high yield bonds to +7.11% or within 80bps of the annual coupon of the high yield index at the beginning of the year.

High nominal yields and discount prices remained en vogue, evidenced by back-to-back months of high risk credits posting outsized gains relative to high quality bonds. While a rising tide continued to lift all boats, capital aggressively flowed toward the few remaining opportunities to add convexity to a general reflation in asset prices / increase in animal spirits. CCC-rated bonds outperformed BB-rated bonds by 164bps in December.

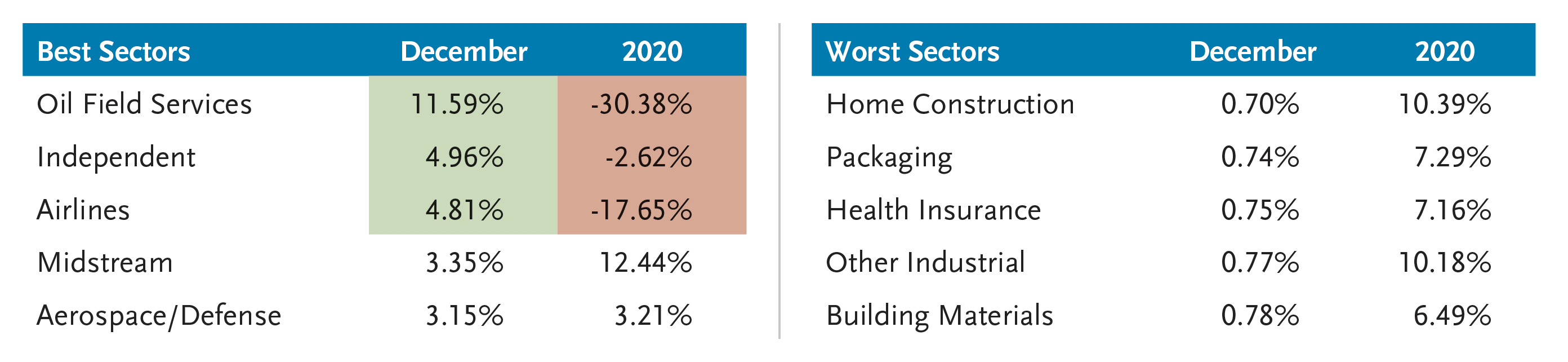

Further parallels to November can be drawn at the sector level as Oil Field Services, Airline, Independent E&P and A&D bonds sustained their market leading gains two months running. Stated succinctly in last month’s memo, those sectors where ANY discount and yield remain realized outsized gains during the month. Not surprisingly, the top performing sectors in December (and November) are among the worst performing sectors on the year.

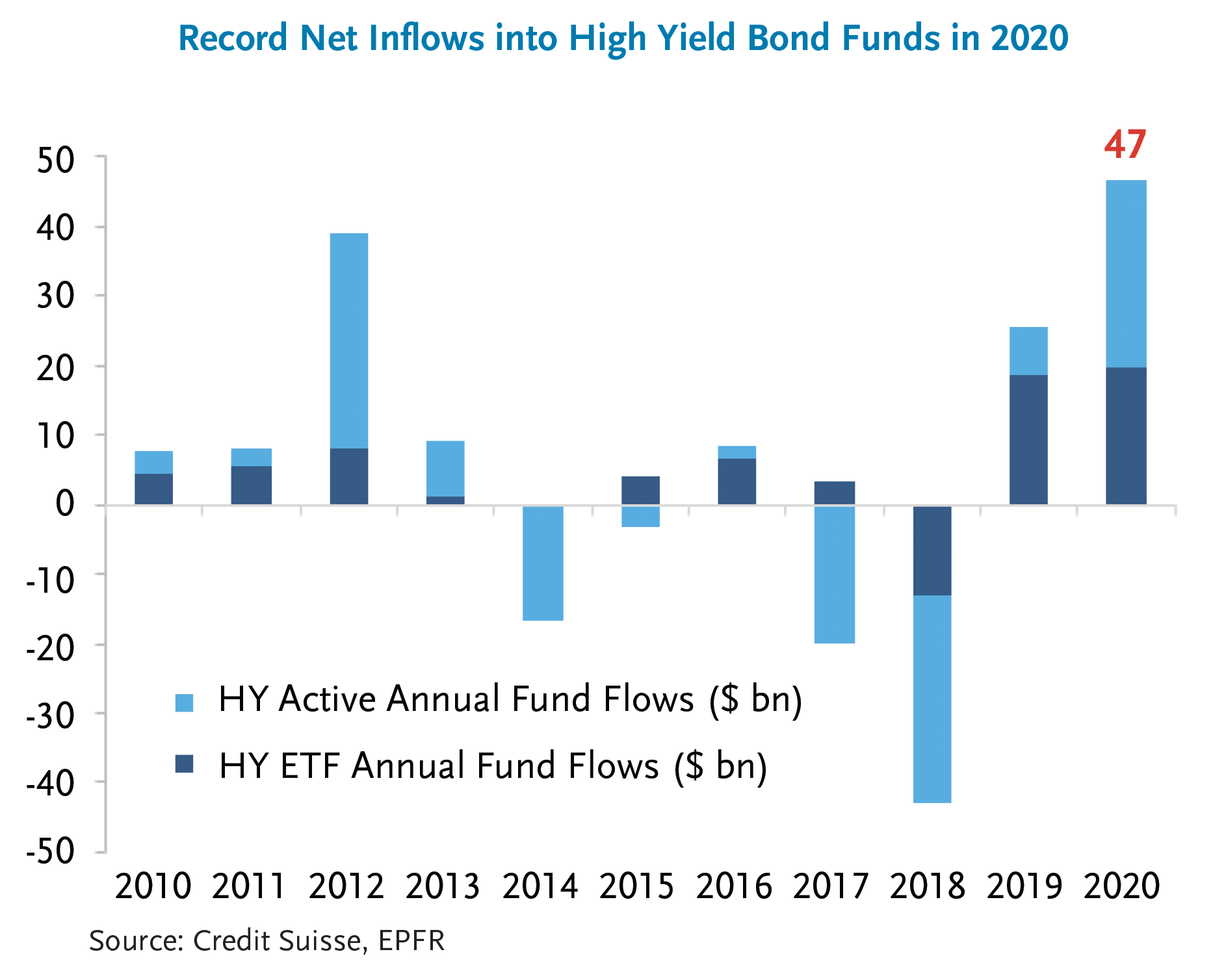

Facteurs techniques

High yield funds saw modest redemptions in December of -$884mn to close out a record setting year for capital flows into the asset class. High yield mutual funds and ETFs took in $47bn in 2020, recovering from a near $25bn exodus through March 23rd when the Fed stepped in with its corporate lending facilities. From that inflection point, over $70bn of liquidity flowed into the high yield bond market, attracted to the high (relative) yields on offer.

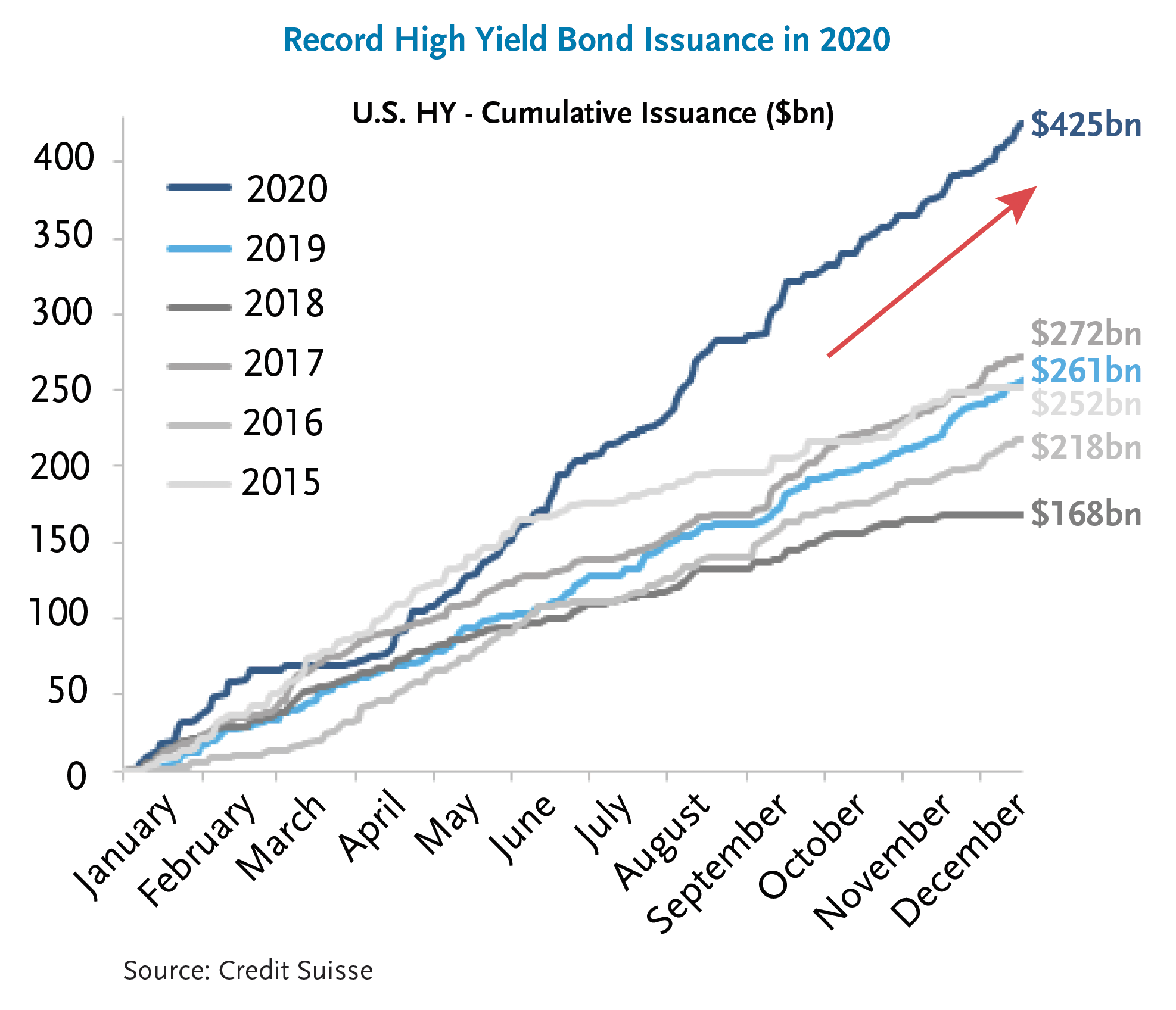

The primary market was active in December as the few borrowers remaining that hadn’t yet accessed fresh capital in 2020 scrambled to lock in record low financing costs before markets closed for the holidays. Over $30bn in USD-denominated debt was issued in December, bringing 2020 gross issuance to a record $425bn. Fittingly, the last deal of the year was a new unsecured bond issued by independent natural gas producer Antero Resources. The borrower, once a rising star candidate, had been barred access to the capital markets for the better part of the past two years as investors soured on the company’s fundamental prospects. Emblematic of the extreme accommodativeness of the high yield credit market by the end of 2020, Antero was able to issue a new $500mn, 6-year unsecured bond at 8.375% to a yield hungry investor base clamoring to buy the deal.

Fundamental Trends

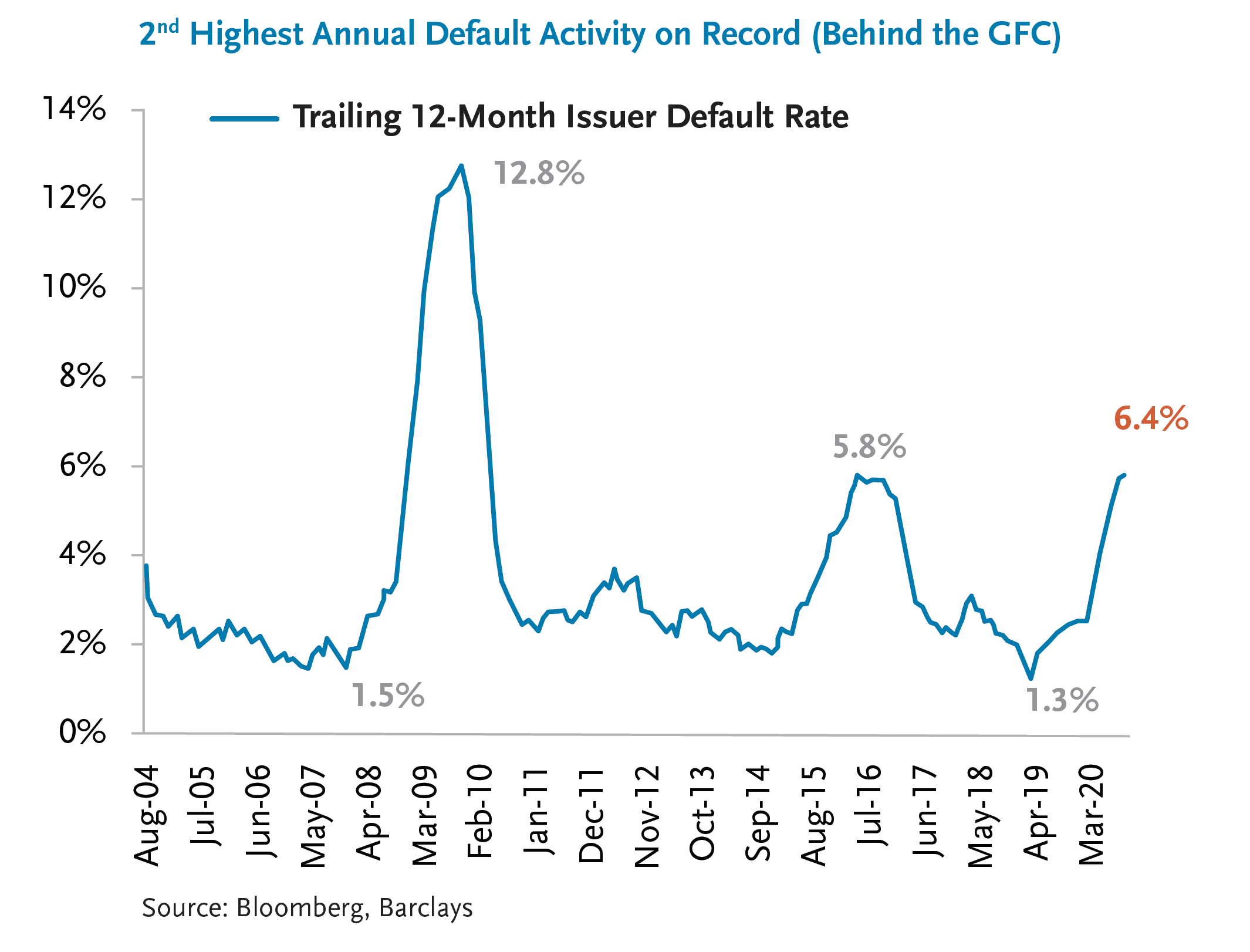

Default activity subsided into year-end following a surge of restructuring activity brought about by the pandemic. Overall, 109 companies defaulted (or executed distressed exchanges) on bonds and loans in 2020, resulting in an annual default rate of 6.4%, the second highest annual default activity on record. By the end of December, however, capital markets re-opened to the vast majority of stressed / distressed borrowers that managed to survive. Currently, less than 3% of high yield bonds trade at spreads wide of 1,000bps (a barometer for the percent of high yield borrowers that lack access to traditional funding). However, even borrowers in this sub-3% cohort are finding ways to access fresh capital by negotiating creative solutions directly with lenders (TCW included), typically by offering priming liens on valuable, unencumbered assets. We believe this theme of capital solutions is likely to persist, particularly in the event of a slow and less even recovery from the pandemic, offering an avenue for proactive investors to manufacture attractive (and differentiated) risk-adjusted returns.

PROSPER NEWS

Get the latest fund managers news, comments or analyses.

TCW – Q1 2025 Talking Points

TCW Q1 2025 TALKING POINTS The TCW Group comments the Fixed Income market for the first quarter 2025 and presents its views going ahead. Please click on the link below to read the TCW Q1 2025 Talking Points.PROSPER NEWS Get the latest fund...

Prosper Stars & Stripes – Market Review Q4 2024

Prosper Stars & Stripes : Review Q4 2024 by Christopher Hillary, Roubaix Capital CEO and Fund Manager. During the fourth quarter of 2024, Prosper Stars & Stripes gained 2.6% compare to the Small and Mid caps market which gained 0.3%. Christopher Hillary...

PWLSE : L/S fund launch

Press releaseProsper Professional Services Announces the Launch of the UCITS Fund: Plurimi World Long Short Equity (PWLSE): Innovation Driving Performance Prosper, a key player in fund distribution for professional clients based in Switzerland, announces the launch of...

Wish to be informed ahead of the crowd through our emails?

Sign up to participate in the next events & presentations.

Retour

Retour